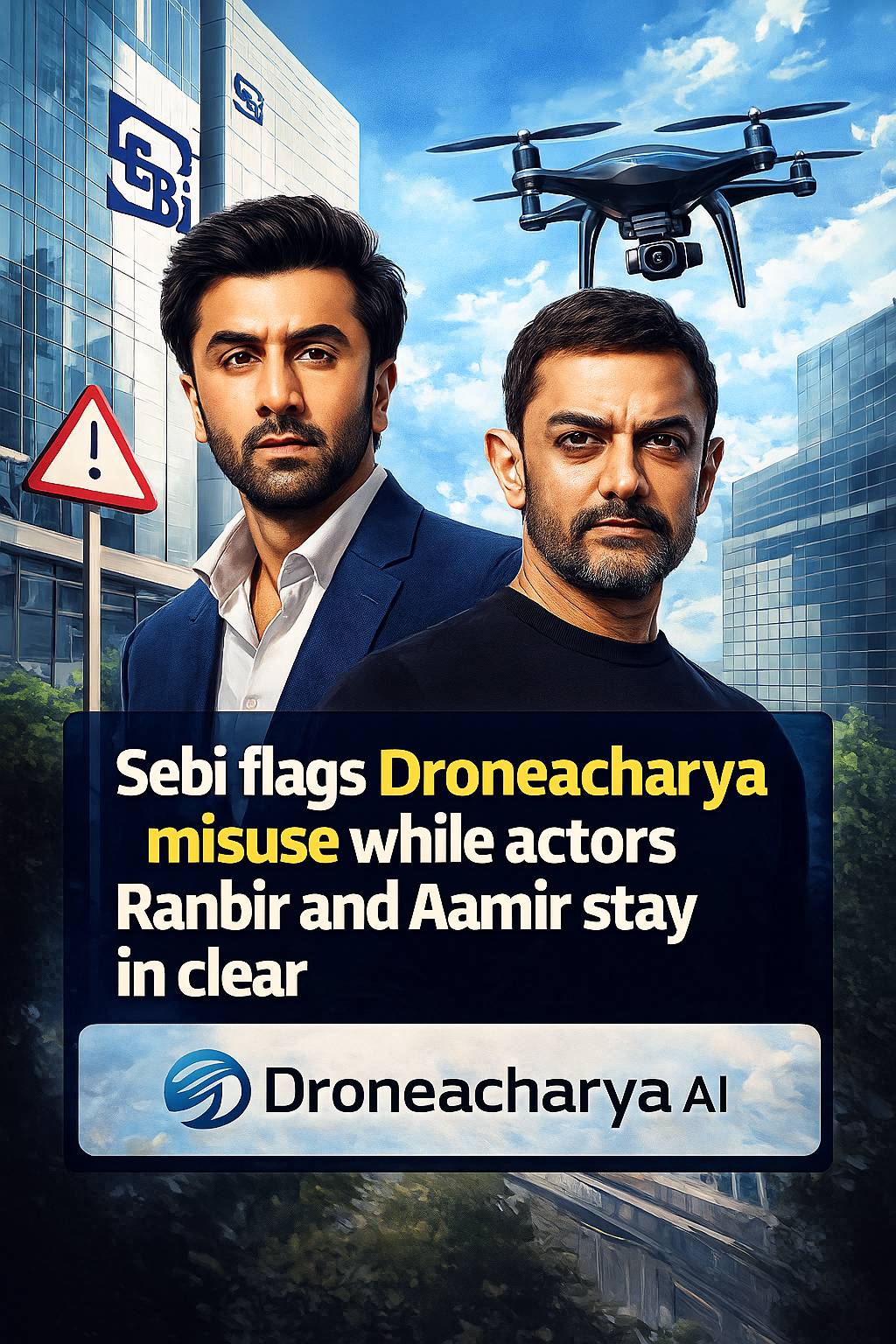

When Droneacharya Aerial Innovations made its splashy debut on the SME platform in December 2022, it quickly became one of the most celebrated listings of the year. Its success owed much to the buzz surrounding its backers — a mix of Bollywood star power in Ranbir Kapoor and Aamir Khan, plus market stalwart Shankar Sharma. But just two years later, what began as a story of entrepreneurial promise has turned into a cautionary tale of regulatory scrutiny and alleged misuse of investor trust.

Sebi Cracks Down on Droneacharya Over Fund Misuse

The Securities and Exchange Board of India (Sebi) has delivered a strongly worded order against Droneacharya Aerial Innovations, alleging serious corporate governance failures and financial impropriety. According to the regulator’s findings, the company, along with its promoters Prateek Srivastava and Nikita Srivastava, diverted funds raised through the IPO and misrepresented its financial position in subsequent disclosures. The Sebi order bars the company and key executives from participating in the securities market for two years.

Investigators found that funds meant for business expansion and technological development were routed to related entities or used for purposes unrelated to the stated objectives of the public issue.

Adding to Sebi’s concerns was what it described as the “orchestrated maintenance” of Droneacharya’s stock price following its listing. The regulator noted that a series of inflated announcements, coupled with limited financial transparency, helped sustain high valuations beyond what fundamentals would justify. Collectively, these findings present a stark reversal from the optimistic projections that once defined the company’s early market narrative.

Ranbir and Aamir Named Only as Passive Investors

Among the most notable details from Sebi’s notice is the clarification about the roles of Bollywood actors Ranbir Kapoor and Aamir Khan. While their names had featured prominently in early reports about Droneacharya’s IPO, the regulator explicitly stated that both were passive, financial investors with no role in day-to-day management, board decisions, or operational strategy. Neither actor has been found guilty of any violations, and their involvement appears limited to early-stage, non-controlling stakes purchased before the listing.

Sebi’s action against Droneacharya Aerial Innovations is a reminder that regulatory compliance and transparency remain the cornerstones of sustainable market credibility. The case shows how quickly fortunes can turn when companies stretch ethical and financial norms, regardless of how glamorous their backers may be. For Ranbir Kapoor and Aamir Khan, the episode appears to end without personal repercussions, but for India’s startup ecosystem, it is a wake‑up call on the risks of mixing market momentum with managerial misjudgment.